Wholesale Real Estate Contract: Template & FREE PDF Download

Jan 20, 2026

- What: A wholesale real estate contract secures your right to purchase a property at a discount so you can assign that right to another investor for a fee.

- Why: Wholesale real estate contracts enable low-capital, lower-risk deals without taking title or handling renovations, helping beginners and pros monetize opportunities quickly.

- How: Use a Purchase & Sale Agreement with an assignment clause, pair it with an Assignment Agreement, or use a double close when assignment isn’t allowed. Always ensure clear disclosures and compliant language.

Inside this article, you’ll learn the different types of contracts used in wholesaling, how assignment agreements actually work, the clauses you must include for protection, answers to the most common contract questions, and, of course, your FREE downloadable wholesale real estate contract PDF template so you can take action immediately!

- What Is Wholesaling Real Estate?

- What Is A Wholesale Real Estate Contract?

- [FREE DOWNLOAD] Wholesale Real Estate Contract PDFs

- Wholesale Purchase & Sale Agreements

- Wholesale Real Estate Assignment Contract

- Lease Option Agreement

- Assignment of Contract vs. Double Close

- How To Write A Wholesale Real Estate Contract

- Wholesale Real Estate Contract Template

- Who Is Needed To Complete A Wholesale Real Estate Contract?

- Wholesale Real Estate Contracts: FAQs

After being in real estate for over a decade and wholesaling houses in over a dozen states, I can assure you that getting your offer accepted by a seller is often the single most important element in closing a wholesale deal. As I like to say, if you’re not making any offers and getting them accepted, you’re not closing any deals.

And while most people focus on the price and the terms, it’s also your ability to understand and articulate the wholesale real estate contract confidently to a seller, which can make all the difference in getting the seller to commit to accepting your offer.

Real estate contracts are very intimidating when you’re a new investor - and can cause you to become paralyzed and even miss out on great opportunities. However, it’s vital to think of these wholesale contracts as the money-making tools that they are.

Once you understand the basic concepts and get practice filling these out, it’s actually pretty easy to fill out real estate contracts for wholesaling.

These pieces of paper can result in tens of thousands of profit per deal in your wholesaling and flipping business when you successfully complete a transaction.

These literal sheets of paper and ink govern the transaction between you, the property owner, and your end buyer.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income, without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today so you can stop wondering and start closing.

What Is Wholesaling Real Estate?

Wholesaling real estate is when a buyer and a seller enter into a real estate contract, typically on a property that is ripe for redevelopment and is acquired at an attractive price for an investor. Initially, you, as a wholesaler, are the buyer on the contract with the property owner.

- Let’s say you get it under contract for $200,000.

- Then, you find a cash buyer, typically a fix-and-flipper or a buy-and-hold investor, who wants to buy the property at a higher price, say $220,000.

- You would then assign the contract to the new buyer at the price of $220,000.

- They would close on the property under the terms of your original contract, and you would get paid the difference of $20,000 as an assignment fee.

Two Main Ways to Wholesale A Deal

- Assignment of Contract: The buyer, also referred to as the “wholesaler,” then assigns their equitable interest in that contract to a different buyer for a fee, called an “assignment fee.”

- Double Closing: When the wholesaler closes on the property, then immediately resells it to the end buyer. The new buyer closes on the property in place of the original buyer, and they end up with a great property to redevelop or pursue their real estate investment strategy of choice.

What Is A Wholesale Real Estate Contract?

A wholesale real estate contract is a legally binding agreement between a property seller and a wholesaler that gives the wholesaler the right to purchase the property and assign those rights to another buyer for a profit.

You’re not buying the home yourself. You’re securing control of the deal so you can transfer it to an investor for a wholesale fee.

This real estate contract is the heartbeat of the entire transaction. Once it’s signed, you gain what’s called equitable interest, which legally allows you to market your contractual rights, assign the deal, and get paid, while the seller still retains title until closing.

That’s why mastering this document is essential for anyone wholesaling in 2026 and beyond.

Once you lock up a property at a discounted price, you assign the contract to an investor at a higher price, and keep the difference as your profit. That's the wholesaling process in a nutshell.

Depending on how you structure your business, wholesalers use different wholesale real estate contract templates. These include:

Read Also: Wholesaling Real Estate For Beginners: How To Get Started In 8 Steps

💡 Quick Example: How a Wholesale Real Estate Contract Works

Let’s break this down with a simple, real-world wholesale contract for real estate example:

- You sign a wholesale real estate contract with a seller for $120,000.

- You assign the contract to an investor buyer for $135,000.

- The investor closes directly with the seller.

- Your profit: the $15,000 assignment fee.

This structure keeps your risk low while giving you the ability to profit quickly from discounted properties.

Anatomy of a Wholesale Real Estate Contract

| Clause | What It Does | Sample Contract Text (Copy/Paste) |

|---|---|---|

| Purchase Price | Defines the specific amount you are contracting the property for. | "The total purchase price to be paid by Buyer is $________." |

| Earnest Money | Shows good faith; kept low ($10-$100) to limit your financial risk. | "Buyer shall deposit $100.00 as Earnest Money with the Closing Agent within 3 days of acceptance." |

| Inspection Contingency | Gives you a specific window to inspect the property and back out if you can't find a buyer. | "Buyer shall have a period of [14] days (The Inspection Period) to inspect the Property. Buyer may terminate this Agreement for any reason or no reason at Buyer's sole discretion during this period." |

| Assignment Clause | Legally allows you to transfer (assign) the contract rights to an end buyer for a fee. | "Buyer reserves the right to assign this Agreement to a third party without further consent from Seller. Seller agrees to cooperate with the assignment process." |

| Closing Date | Sets the timeline for the final transaction (typically 14-30 days). | "Closing shall occur on or before [Date]. Buyer has the right to extend closing for [X] days if necessary to clear title." |

*Note: The sample text above is for educational purposes. Always have a local real estate attorney review your specific contract to ensure it complies with your state's laws.

3 Common Wholesale Contracts in Real Estate

The most common contracts you’ll use in wholesaling include:

- Real Estate Purchase & Sale Agreement: Establishes equitable interest.

- Wholesale Real Estate Assignment Contract: Transfers your rights to an end buyer.

- Lease Option Agreement: Gives control with an assignable purchase option.

These agreements aren’t unique to wholesalers. Motivated sellers, landlords, flippers, and investors all encounter these contracts throughout the real estate investing process.

Read Also: Free Real Estate Purchase & Sale Agreement: PDF & Template

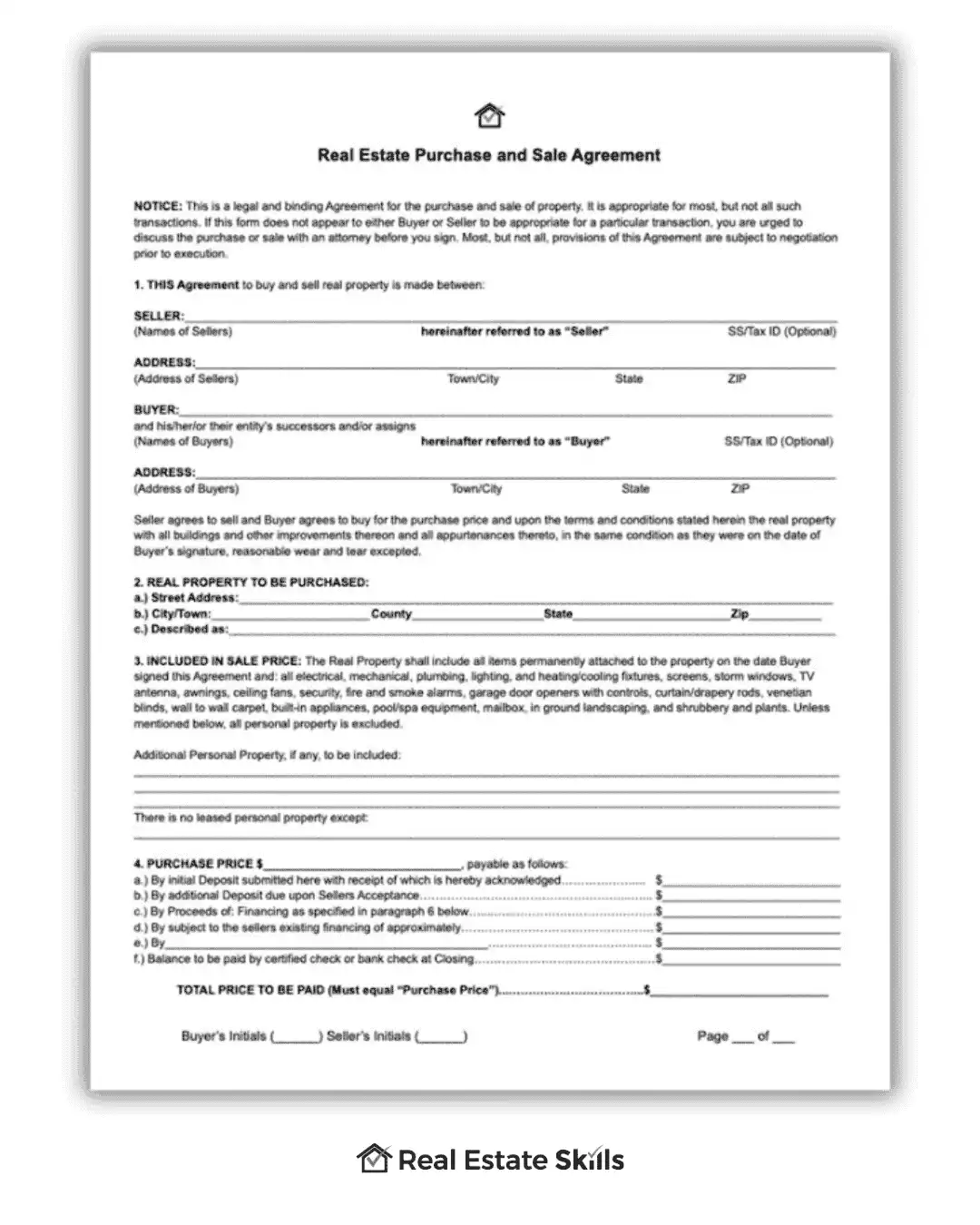

Wholesale Real Estate Contract PDF [FREE DOWNLOAD]

If you’re new to wholesaling or simply don’t have the time to draft your own agreement from scratch, you’re in the right place. We offer a free download of a wholesale real estate contract PDF, allowing you to get started quickly with a professionally structured template that fits real-world investing scenarios.

You'll receive the following FREE wholesale contract templates provided by Real Estate Skills, including:

- Real Estate Purchase & Sales Agreement PDF

- Wholesale Real Estate Assignment Contract PDF

With your free wholesale real estate contracts, you can confidently move forward with one of the most "intimidating" parts of the wholesale deal. Now, you can move forward knowing you have the proper foundation in place.

Read Also: How To Talk To Cash Buyers & Find Their Buying Criteria [FREE CASH BUYER SCRIPT]

What Are Real Estate Purchase & Sale Agreements?

A Real Estate Purchase and Sale Agreement (PSA) is a legally binding document that outlines the terms of buying and selling a property.

It establishes the purchase price, closing timeline, contingencies, and responsibilities of both the buyer and seller, making it the foundation of every real estate transaction.

For wholesalers, the Purchase & Sale Agreement is especially important because it provides an equitable interest in the property. This interest is what allows you to legally market the deal and assign the contract to another investor for a profit.

There are hundreds of state-specific versions of this contract, so it’s wise to consult a real estate attorney to ensure you’re using a compliant, investor-friendly form. Different states may require additional disclosures or language to make the agreement fully enforceable.

Assignable vs. Non-Assignable Purchase Agreements

If you plan to assign the contract, your Purchase Agreement must either:

- Include an assignment clause that expressly allows you to transfer your contractual rights, or

- Be reviewed to ensure it does not contain an anti-assignment restriction.

This small detail is one of the most common mistakes new wholesalers make, and it determines whether you can legally assign the contract or whether you’ll be forced into a double close.

How Purchase Agreements Work in Different Wholesale Strategies

Depending on your exit strategy, the number of purchase agreements used changes:

- Assignment of Contract: You use one Purchase & Sale Agreement with the seller, then assign it to the end buyer.

- Double Closing: Two separate purchase agreements are required, one between you and the seller, and another between you and the end buyer.

- Wholetailing: You purchase the property outright (first agreement) and then sell it using a second agreement.

Understanding the structure of the Purchase & Sale Agreement and how it fits into your chosen wholesale strategy is essential for avoiding legal issues and ensuring your deals close smoothly.

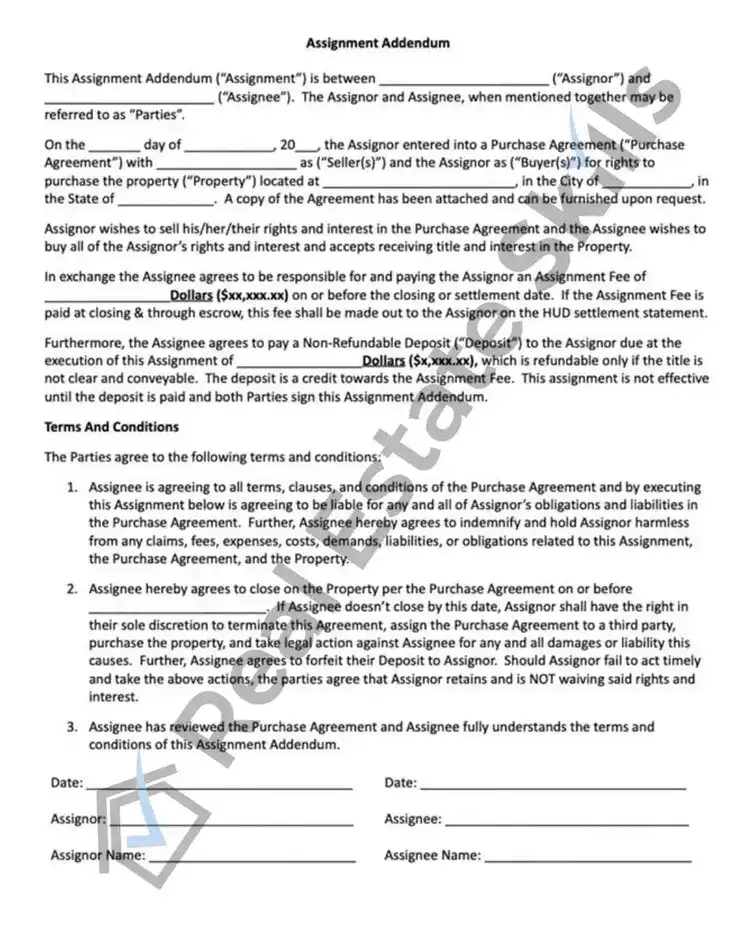

What Is a Wholesale Real Estate Assignment Contract?

A Wholesale Real Estate Assignment Contract is the legal document that allows a wholesaler to transfer their equitable interest in a property to another buyer.

Instead of purchasing the property themselves, the wholesaler signs a Purchase & Sale Agreement with the seller, then “assigns” their rights to an end buyer for an agreed-upon assignment fee.

Understanding this distinction is crucial: you are not selling the property, you are selling your contractual right to purchase it.

This makes the assignment contract the key instrument that legally connects the original seller, the wholesaler (assignor), and the end buyer (assignee).

For an assignment to be valid, the underlying wholesale real estate contract must be assignable.

Some purchase agreements include anti-assignment clauses or require written permission from the seller.

Because of this, wholesalers should always review (or have an attorney review) contract language to ensure it clearly permits assignment and outlines any restrictions.

A strong assignment contract should spell out:

- Exact rights are being transferred to the end buyer

- Assignment fee amount owed to the wholesaler

- Deadlines and closing specifics for the final transaction

- Earnest money requirements and who deposits them

- Whether the wholesaler remains liable if the end buyer defaults

The Doctrine of Equitable Conversion plays a crucial role in this process. Once a real estate purchase agreement is signed, the buyer becomes the equitable owner, and the seller holds the legal title to the property.

Therefore, when a wholesaler sells the contract, they're selling their equitable interest or rights within the contract terms to another buyer.

It is important to note that certain properties, like HUD homes, REOs, and listed properties, are not open to assignment contracts. REO properties, for instance, have 90 days before they can be resold.

Read Also: How To Find And Buy REO Properties: The Investor's Guide

What Is a Lease Option Agreement?

A Lease Option Agreement is a hybrid real estate contract that combines three components into one deal structure:

- Purchase & Sale Agreement: outlines the future purchase terms.

- Rental (Lease) Agreement – allows the buyer/tenant to occupy the property.

- Option Contract: grants the exclusive right (but not obligation) to buy the property.

In a standard lease option, the buyer (or tenant-buyer) rents the property under a traditional lease with agreed-upon terms like monthly rent, security deposit, and length of tenancy. Alongside this, they receive a separate option to purchase the property at a predetermined price, typically within 12–36 months.

The Option Contract spells out the purchase terms and gives the buyer the legal right, without obligation, to enter escrow later based on the original Purchase & Sale Agreement.

The option period is the timeframe in which the buyer can exercise that right. Once this window expires, the seller is no longer required to honor the purchase terms, and the buyer’s option terminates.

The option fee (also called “option consideration”) is a non-refundable payment made to the seller in exchange for securing this purchase right. In most markets, this ranges from 1%–5% of the future purchase price, and it may or may not apply toward the final sale depending on local norms and contract wording.

Why Lease Options Matter in Wholesaling

Lease option agreements can be powerful tools for wholesalers because they:

- Provide an equitable interest allowing you to legally market or assign the deal.

- Work with sellers who need a solution but aren’t ready for a traditional sale.

- Allow buyers time to secure financing while locking in a purchase price.

This strategy is often used when sellers prefer a tenant first or when a lower-equity deal needs a creative structure to make the numbers work.

When Lease Options Are Useful

- Properties needing mild repairs but not full rehab.

- Sellers who want a monthly income before selling.

- Buyers who need time to improve their credit or financing.

- Wholesalers who want additional exit strategies beyond assignment.

Understanding lease options helps investors structure more flexible, win-win contracts especially in competitive or tight-inventory markets.

Assignment Contract Vs. Double Close

Remember, an Assignment Contract happens when a wholesaler secures a deal with a seller and then assigns their contract rights to a buyer. This way, the wholesaler makes money without officially owning the property.

On the other hand, a Double Closing involves the wholesaler both buying the property from the seller and then selling it to a buyer. In this situation, the wholesaler briefly owns the property before selling it off. This process involves two separate transactions, each with its own costs and fees.

The wholesaler appears on the title and must cover all costs associated with buying and selling properties.

To help you wholesale LEGALLY in any state using the right contracts, please watch our in-depth guide below:

Things to consider when choosing between assignment contracts and double closings include potential profit, the buyer's financing plans, and how quickly the buyer can access funds. By weighing these factors, investors can make the best choice for their situation.

No one strategy is better than the other; it all depends on the specifics of the deal and the investor's circumstances. Today, some state laws require a double close or other strategy for wholesaling real estate. Be sure to read up on your state's laws before moving forward.

Read Also: Double Closing: The Ultimate Guide

How To Write A Wholesale Real Estate Contract

Here’s a simple breakdown to help beginners structure their contract correctly:

- Identify the Parties: Clearly list the seller’s full name and your name (or LLC).

- Define the Property: Include the complete address and legal description.

- Set the Purchase Price: State exactly what you’re contracting the property for.

- Add Earnest Money Terms: Keep this minimal to limit your risk (often $10–$100).

- Include an Inspection Period: This protects you while marketing the wholesale contract for real estate to buyers.

- Insert an Assignment Clause: This confirms you can assign your contractual rights.

- Define the Closing Date: Most wholesalers use 14–30 days.

- Disclosures & Addenda: Add any state-required disclosures to stay compliant.

Writing a wholesale real estate contract is much simpler than most beginners expect. All wholesale agreements follow the same core structure, whether you download a template or create your own from scratch.

The key is making sure every legally required component is included so the contract is enforceable and so your wholesale fee is fully protected.

At a minimum, every wholesale contract must clearly define the parties, the purchase terms, your inspection period, and assignment rights. Leaving out any of these can cause delays, legal issues, or even kill an otherwise profitable deal.

Wholesale Real Estate Contract Essentials

Below are the essential elements that make a wholesale real estate contract legally binding:

- Competent Parties: All parties must be legally capable of entering into a contract. This includes being of legal age, mentally competent, and identifiable. Some states have specific guidelines regarding capacity, so be sure to check your state’s contract rules.

- Mutual Assent: Both parties must agree to the same terms. This typically happens when the seller accepts the wholesaler’s offer, and both sign the agreement, confirming that all terms are clearly understood and agreed upon.

- Consideration: Consideration is anything of value exchanged between the parties. In wholesaling, this is commonly a small earnest money deposit. Without consideration, the contract can be ruled void because no value was exchanged.

- Legality of Purpose: A wholesale real estate contract must serve a lawful purpose and comply with state regulations. Because wholesaling involves assigning contractual rights, not selling property without a license, it is legal when structured correctly.

If any of these foundational components are missing, the wholesale contract may be ruled invalid or unenforceable. A missing clause or ambiguous term can stall a closing, jeopardize your wholesale fee, or create legal liability, so accuracy matters!

Key Components Your Wholesale Contract Must Include

Below is a deeper explanation of each section in the template above, so you know exactly why each clause matters and how to customize it:

- ✅ Parties Involved: Identifies who is entering the agreement. Use full legal names and include LLCs if you’re contracting as an entity.

- ✅ Legal Description: This property description includes the address, the APN, and legal description to avoid disputes.

- ✅ Purchase Price: The exact dollar amount you’ve negotiated with the seller. This establishes your equitable interest.

- ✅ Deposits: Earnest money demonstrates commitment, but should remain low for wholesalers to limit financial exposure.

- ✅ Closing Costs: States that will pay title, escrow, notary, and transfer tax fees.

- ✅ Financing: Specifies whether the purchase is cash or financed and includes financing-related contingencies.

- ✅ Property Condition & Disclosures: Required by law. Depending on the state, this may include a TDS or other mandated forms.

- ✅ Inspection Rights: Protects you from hidden defects and gives you time to line up your end buyer.

- ✅ Possession & Closing Date: Sets the timeline and whether the property must be delivered vacant.

- ✅ Contingencies: Inspection, title, financing, or assignment contingencies. Each contingency protects your wholesale exit strategy

Do You Need A Real Estate License To Write A Wholesale Real Estate Contract?

No, you do not need to be a licensed real estate agent to write a wholesale real estate contract. Remember, wholesaling involves selling contractual rights, not representing a seller or buyer as an agent.

As long as these key elements are included, your contract will be valid, legally enforceable, and ready for assignment.

Remember: many states require specific disclosures or contract wording, so always have an attorney review your wholesale contract template, especially when creating one from scratch.

With the right structure in place, these templates make your wholesaling business faster, smoother, and legally protected.

Wholesale Real Estate Contract Template

If you're searching for a wholesale real estate contract template you can confidently use (or model your own after), this section breaks down every clause your contract must include.

It also gives you a visually formatted sample layout so you know exactly what it should look like.

👉 Click here to download your own Wholesale Real Estate Contract Template!

Use the styled example below as a guide:

📄 Wholesale Real Estate Contract Template (Sample Layout)

This is a sample structure for educational purposes. Always consult a local attorney before finalizing legal documents.

1. Parties Involved

Seller: __________________________________________

Buyer/Wholesaler: __________________________________

Entity (if applicable): _____________________________

2. Property Information

Address: _________________________________________

Legal Description / APN: __________________________

Property Type: ____________________________________

3. Purchase Price & Earnest Money

Purchase Price: $ ________________________________

Earnest Money Deposit: $ __________________________

4. Closing Terms

Closing Date: _____________________________________

Occupancy / Possession: _________________________

Closing Costs Paid By: ☐ Buyer ☐ Seller ☐ Split

5. Inspection Period

Buyer has the right to inspect the property for: ____ days.

6. Assignment Clause

Buyer reserves the right to assign this contract to another party without further consent from Seller.

7. Disclosures

- Transfer Disclosure Statement (TDS) (if required by the state)

- Lead-Based Paint Disclosure (for homes built before 1978)

- Radon Gas Disclosure (if applicable)

8. Signatures

Seller Signature: ___________________ Date: ___________

Buyer Signature: ____________________ Date: ___________

Quick filled-out example:

Seller: John & Jane Seller Buyer/Wholesaler: ABC Home Buyers, LLC Address: 123 Main St, Anytown, ST 12345 Purchase Price: $120,000 Earnest Money: $100 Closing Date: On or before 30 days from acceptance Assignment: Buyer may assign this Agreement to another party without further consent from Seller.

Read Also: Wholesale Real Estate: Step-By-Step Guide & Deal Calculator

Who Is Needed To Complete A Wholesale Real Estate Contract?

Now that you understand the structure of a wholesale real estate contract, let’s break down exactly who is involved in completing one. The contract itself is simple, but the people behind it are what make the deal legal, smooth, and profitable.

You can download a wholesale real estate contract PDF, get one from a title company or attorney, or even create your own. But no matter which template you use, four key parties are required to complete every wholesale transaction:

The 4 Roles Required in a Wholesale Real Estate Contract

- The Seller: The property owner who agrees to place the home under contract. They sign the purchase agreement and provide disclosures.

- The Wholesaler: The “middleman” who negotiates the deal with the seller, gains an equitable interest through the contract, and assigns the agreement to an investor buyer.

- The Buyer (End Buyer): Typically, a cash investor who purchases the contract from the wholesaler and closes directly with the seller.

- The Title Company: The neutral third party responsible for verifying title, preparing closing documents, distributing funds, and ensuring the assignment or double close is completed legally.

Why the Title Company Is Essential

A title company protects all parties by confirming the title is valid, spotting liens or issues, handling escrow, and issuing title insurance. They also ensure your assignment fee is paid and that the transaction closes properly.

How the Parties Work Together (Simple Workflow)

- Step 1: Seller signs the purchase and sale agreement with the wholesaler.

- Step 2: The Wholesaler assigns the contract to the end buyer using an assignment agreement.

- Step 3: The Title company prepares closing documents and confirms the title is clear.

- Step 4: The End buyer closes directly with the seller, and the wholesaler receives their assignment fee.

Each person plays a critical role when dealing with a wholesale contract for real estate. Without the seller, there’s no deal. Without the wholesaler, there’s no assignment. Without the buyer, there’s no closing. And without a competent title company, none of it is legally protected.

Whether you’re brand new or scaling your business, understanding who is involved in a wholesale real estate contract helps you move with confidence and avoid costly mistakes.

Read Also: Wholesale Real Estate Mentor: The ULTIMATE Beginner's Guide

Advantages of Wholesale Real Estate Contracts

A wholesale real estate assignment contract offers some of the biggest advantages in the entire real estate investing world, especially for beginners.

Here are the most powerful benefits of using assignment contracts:

- Quick Profits & Fast Turnaround: Most assignment deals close in 30 days or less. Skilled wholesalers who consistently submit offers can complete 5–10 assignment deals per month. Once you understand how to find motivated sellers and pair them with eager buyers, you can build a consistent, repeatable deal pipeline.

- No Credit or Income Requirements: Because you're assigning your contractual rights not buying the property, you don’t need a mortgage, proof of funds, or lender approval. The end buyer handles all financing and underwriting, making this an ideal entry point for investors with limited credit or capital.

- Lower Financial Risk: You never take title, so you avoid the holding costs, repairs, property taxes, and risks that traditional investors face. Your only responsibility is securing the contract and assigning it, dramatically reducing your exposure.

- Accelerated Real Estate Education: Wholesaling forces you to learn the fundamentals quickly: evaluating deals, analyzing ARV, estimating rehab costs, understanding contract clauses, negotiating with sellers, and marketing to buyers. You’re learning the entire real estate investing process at high speed, without needing to buy the property.

- Builds a Valuable Buyers List: Every assignment deal expands your network. You’ll naturally build relationships with cash buyers, flippers, landlords, agents, contractors, and lenders. These contacts create long-term opportunities far beyond wholesaling, JV deals, flips, rentals, and private capital partnerships.

- Deep Local Market Knowledge: When you evaluate dozens of properties every week, you quickly learn neighborhood trends, price points, rental numbers, buyer demand, and what makes a property desirable. This knowledge gives you a competitive advantage in any future investment strategy.

For beginners, mastering wholesale real estate assignment contracts is one of the fastest ways to gain real-world investing experience. You’re learning how to analyze deals, negotiate with sellers, and structure contracts, all without needing to own the property yourself.

Just remember: your success will come from consistency, submitting offers daily, and building a strong buyers list. With the right education and strategic effort, wholesaling can become the foundation of your entire real estate investment journey.

Read Also: 17 Best Cities To Wholesale Real Estate

Challenges Of Wholesale Real Estate Contracts

To effectively navigate a wholesale contract for real estate, it's important to be aware of potential challenges along the way. This knowledge allows you to develop a more strategic approach to overcome these hurdles and ultimately achieve success. Here's a look at some of the challenges associated with wholesale real estate assignment contracts—and exactly what to do about each one:

- Income Fluctuations: Wholesaling real estate contracts can result in lucrative profits within a relatively short time frame. However, the consistency of the income can vary, largely because finding distressed properties and matching them with the right buyers can take time. But remember, as a wholesaler, your primary role is to find the best deal for all parties involved, and the rewards can be well worth the effort and patience.

- What to do: Set a weekly offer goal (for example, 5–10 written offers per week) and track it in a simple spreadsheet or CRM so your pipeline stays full even when a few deals fall through.

- Creating a Strong Buyers List: A key to success in wholesaling is having a solid list of potential buyers. Building this network can be a gradual process, but it's an investment that can offer you considerable flexibility when you need to sell a property quickly. A good strategy is to establish connections with repeat buyers known for their reliability.

- What to do: Commit to adding 3–5 qualified buyers per week by networking at REIA meetings, posting in local investor Facebook groups, and asking every buyer for their “buy box” and proof of funds before adding them to your list.

- Discovering Distressed Properties: Finding distressed properties can indeed be a bit challenging, often requiring you to extend your search beyond your local market. While there isn't a one-size-fits-all method for this, remember that with each property you uncover, you're honing your research and negotiation skills. This might involve scanning newspapers, driving around neighborhoods to spot poorly maintained homes, or leveraging direct mail and social media marketing campaigns.

- What to do: Choose 2–3 lead channels (for example, MLS “fixer” searches, driving for dollars, and one direct mail or SMS list) and schedule specific weekly blocks to work each channel instead of randomly hunting for deals.

While these challenges might seem intimidating at first, they are part and parcel of the wholesaling journey. Keep in mind that every hurdle overcome is a step forward in your wholesaling education and experience.

Ready to take the next step? Join our comprehensive real estate wholesaling course to deepen your understanding and boost your success rate.

Read Also: How To Find Distressed Properties To Buy

Wholesale Contracts: FAQs & Common Misconceptions

Wholesaling brings with it a multitude of questions, particularly surrounding the pivotal tool of the trade: contracts.

As essential as they are, these contracts often come shrouded in misunderstandings, especially for new investors. Real Estate Skills aims to provide you with concise answers to your most pressing questions, going as far as giving you a wholesale real estate contract PDF to work with.

What Is Wholesaling?

Wholesaling is a strategy where a middleman, or wholesaler, secures under-market-value properties and finds end buyers for those properties. Usually, these properties are distressed and purchased from motivated sellers, but they can also be fully renovated, move-in-ready homes.

A common method is an assignment of contract, where the wholesaler makes an agreement to buy a property and then assigns that real estate wholesale contract to an end buyer before closing. This transfers the right to purchase to another party, who will then renovate the property and sell it for a profit. The wholesaler's profit comes from the difference between the price they set in their contract and the higher price paid by the end buyer.

This method is popular because it doesn't need any capital investment from the wholesaler, there are no closing costs, and payment can be quick.

Other variations of wholesaling include double closings and wholetail deals, which require the wholesaler to fund and close the property.

Why Should You Wholesale Real Estate?

Wholesaling real estate might seem overwhelming, but it offers significant benefits for both new and seasoned investors:

- It presents minimal risk as you're not directly exposed to market fluctuations or property liabilities, unlike traditional homeownership.

- It allows you to capitalize on all leads, turning potential property listings that you might not have time for into profitable contracts.

- Wholesaling requires little to no personal investment as profits are made from selling the contracts, not the properties themselves.

- As a wholesaler, you're not responsible for property repairs; the condition of the property is a factor for the investor to consider.

- The process isn't geographically bound; you can operate your wholesaling business virtually, making it a versatile strategy in competitive markets.

- Wholesaling doesn't require a real estate license, providing an alternative entry point into the property market.

Is A Wholesale Contract Legal?

Wholesale real estate contracts are legal and are a common real estate practice.

Despite the legitimacy of the contracts and process, it is crucial that you are aware of the rules and regulations when it comes to the state the property is in. Similarly, it is widely important for both parties to communicate, agree, and clarify all terms to avoid any conflicts or misconceptions regarding the contract.

Furthermore, according to Restatement Second of Contracts § 317, assignments are allowed in contracts unless it's precluded in the contract.

If there is no assignment clause or a clear prohibition of assignment, it is automatically allowed. However, watch out for clauses in purchase contracts that prohibit assignment. This can be true with forms that Realtors use during the wholesaling process.

For added legal protection, make sure you use a proven wholesaling contract template for your specific state.

What If You Can’t Assign A Property To A Wholesale Contract?

When to Use a Double Close (To Avoid Legal Issues)

In 2026, the standard "Assignment of Contract" isn't always possible. Whether you are dealing with stricter state regulations (like in Oklahoma or South Carolina) or bank-owned properties, the Double Close is your strategic safety valve.

- Legal Compliance: In states that classify "marketing a contract" as brokering without a license, a double close requires you to take title first. As the legal owner of record, you generally have the right to market and sell the property to anyone without needing a license.

- Non-Assignable Contracts: REO (Bank-Owned) and HUD homes often contain strict "Anti-Assignment" clauses. A double close allows you to buy the home legally and resell it immediately, bypassing these restrictions.

- Privacy (Hiding Large Spreads): If you negotiated a massive wholesale fee (e.g., $50,000), the seller might back out if they see that line item on the settlement statement. A double close separates the transactions, keeping your profit private.

If the wholesale real estate contract prohibits assignment, there are two options you can consider: a standard Contract Assignment Addendum or a double closing.

- Contract Assignment Addendum: A standard Contract Assignment Addendum amends the initial contract that prohibited assignment. Most real estate brokers or attorneys will have access to a similar form. In short, a Contract Assignment Addendum explains certain conditions between the seller, the assignor, and the assignee relating to the property at hand. When dealing with purchase contracts that are not assignable, an assignment contract is a strong option to consider.

- Double Closing: In a double closing, an investor buys a property and then resells it swiftly without making any repairs. This process involves two separate transactions. The first is between the investor and the seller, and the second is when the investor sells the property to a new buyer. This can be ideal for contracts that are unassignable to third parties, such as with some REO properties or bank-owned homes.

Do You Get Paid From A Wholesale Real Estate Contract?

One of the great benefits of being a wholesaler is the profit you can earn while putting in little money of your own.

The main way a wholesaler gets paid is from a wholesale fee. The wholesale fee, or assignment fee, is earned when the wholesaler sells an active purchase contract (or lease option contract) and transfers the contractual rights to the buyer/investor.

Another profit center for wholesalers occurs when the wholesaler buys the property and then quickly resells the property to another party at a higher price. This requires the wholesaler to actually close on the piece of real estate. The net profit from "buying low and selling high" is the wholesaler's profit. Since two real estate transactions occur using this wholesaling method, closing costs may be added.

Typically, the amount and logistics of how a wholesaler will get paid are described in the wholesale assignment contract. It may also specify whether or not the wholesaler will be getting paid in escrow or outside of escrow.

What Is Escrow & Why Is It Important For Wholesale Contracts?

According to Rocket Mortgage, “Escrow is a legal arrangement in which a third party temporarily holds money or property until a particular condition has been met (such as the fulfillment of a purchase agreement). It’s used in real estate transactions to protect both the buyer and the seller throughout the home-buying process. Throughout the term of the mortgage, an escrow account will hold funds for taxes and homeowner’s insurance.”

In short, escrow will hold your earnest money and will be applied appropriately throughout your home-buying process.

Nonetheless, if you are getting your wholesale assignment fee paid through escrow, you may receive a check from the title company itself. The money that was put into that account may have included the price that would be used to pay the wholesale fee. On the flip side, being paid outside of escrow entails that the end buyer will pay the wholesaler directly.

Who Buys Wholesale Real Estate Contracts?

As we have discussed these contracts in terms of a seller, wholesaler, and buyer, who falls into the category of being a buyer? Who buys wholesale real estate contracts?

- Rental Property Investors: Rental property investors are a large portion of those who buy wholesale contracts. For example, landlords look for discounted properties that can be fixed up and rented out. These deals must meet their criteria of gaining adequate profit from leasing the home to tenants for passive rental income.

- House Flippers: Fix and flip investors purchase these contracts as they can flip the house, especially those in distressed and dilapidated conditions.

- Property Developers: Property developers purchase these contracts, hoping to find land that can be developed. The property is then torn down or scraped, and then used to build on. An assemblage of contiguous properties is also a possibility for property developers from these contracts. This is when an investor owns a large area of properties, which results in a larger site to develop a larger, more valuable structure, such as an apartment complex or business.

Additionally, wholesalers themselves participate and purchase these contracts. Depending on the property and profit they get from it, they may choose to buy contracts to sell to other investors in their network or keep it as an income-producing rental property.

Can You Get Out Of A Wholesale Real Estate Contract?

A contract is a legally binding document, so don’t hold your breath if you think it’s easy to get out of it. As you sign a contract, you agree to the terms and conditions that are listed within that document. You also take on any consequences that may occur with it if you breach the contract.

Wholesale real estate contracts contain contingency clauses that allow a party to terminate the agreement without repercussions when certain terms aren't met. This part of the contract clarifies any conditions that need to be met in order for the contract to be legally binding. Once the conditions are met, the contract then becomes binding.

A specific contingency to be aware of is the inspection contingency, also called the due diligence contingency. This states a specific time period for the buyer to have the home inspected. With this contingency, the buyer is able to cancel the contract or negotiate certain actions for the seller to take if appropriate for the home.

It is important to note that not all contracts will have an inspection contingency clause. New investors can lose money, even in a low-risk wholesale deal, without the right training and guidance. This contingency clause may be overlooked, so it is important to be aware of it.

Here's an example of a basic due diligence contingency in a contract:

“Closing will take place on or before: ____ at _____ or TBD, Subject to a 45-day period in which the buyer/seller shall be permitted to do necessary due diligence and to clear any title problems.”

So, how do I get out of this contract? There are two options, one good and the other not so much.

The first option is the situation you would typically want. This is when you ask to cancel the contract within the contingency time period. This will typically permit the cancellation of the contract, and your earnest money deposit will be refunded to you.

However, as you have committed earnest money, the situation may not look so hopeful for you if you are outside the contingency period. The earnest money becomes non-refundable when the contingencies in the contract are removed or expire. This will result in the loss of your earnest money deposit if you cancel the contract.

Final Thoughts On Wholesale Real Estate Contracts

We've introduced you to the world of wholesale contracts and examined the wholesaling process in its entirety. It's clear to see how these contracts play a key role and what you need to be mindful of throughout the process.

Wholesaling provides both wealth creation and educational benefits for anyone interested in the real estate business. Remember, your drive and determination will yield benefits far beyond financial gain. The rewards will be clear and tangible.

Legal contracts are critical to wholesaling and demand your serious attention. Read every contract thoroughly.

Knowledge is power when it comes to negotiating outstanding wholesale deals.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income, without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.